The Key Signal Behind Bitcoin's 30% Surge?

Analyzing the Three Conditions of "Stablecoin Exchange Netflow"

Foreword

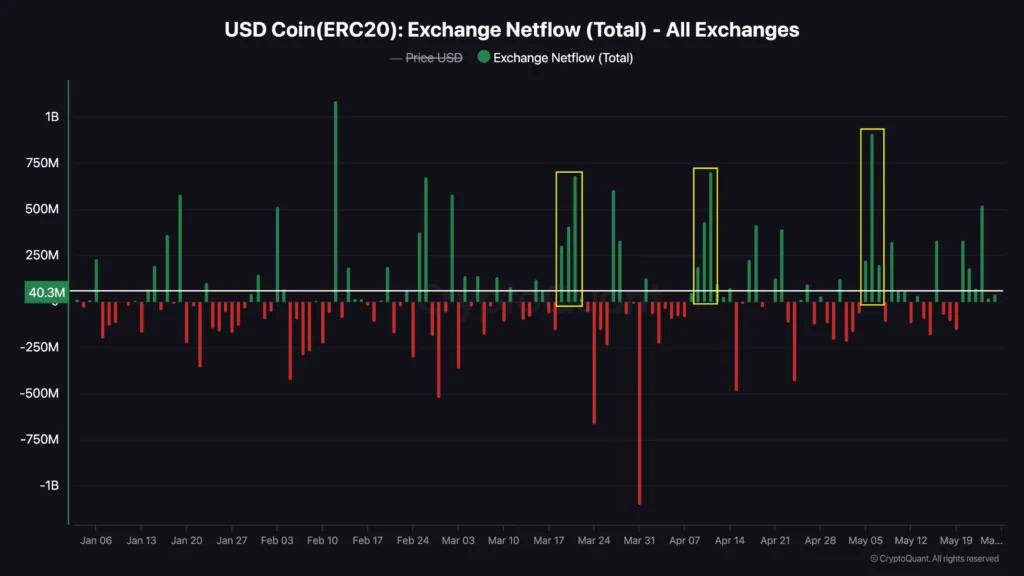

In the cryptocurrency market, the flow of stablecoins has always been a highly valuable indicator, with USDC (ERC20) being a typical representative. Observing market fund movements through exchange netflow can effectively predict subsequent price trends.

This article will use the USDC (ERC20) Netflow indicator from the on-chain tool CryptoQuant, set three clear conditions, and conduct historical backtesting with TradingView to demonstrate its relationship with price, thereby identifying potential trading opportunities.

We have found that when specific conditions are met, BTC usually exhibits a clear and sustained upward trend, which will help traders and investors make more accurate judgments.

Netflow Conditions and CryptoQuant Charts

The analysis conditions are as follows:

Condition 1: The net inflow (Netflow) of USDC (ERC20) on a single day is greater than or equal to $100 million ($100M). Condition 2: Continuous net inflow of USDC (ERC20) for 3 consecutive days, with a net inflow of at least $100 million or more each day. Condition 3: The net inflow (Netflow) of USDC (ERC20) on a single day exceeds $600 million ($600M).

According to historical data:

When Condition 1 and Condition 2 are met simultaneously, the market usually enters a clear upward trend.

When Condition 3 is met simultaneously, the upward movement of BTC usually exceeds 30% or more.

The logic behind these three conditions is:

A large net inflow of USDC usually indicates that funds are starting to move from on-chain to exchanges for buying activity, and the market is about to welcome more funds driving the price upward.

Continuous fund inflows for 3 consecutive days represent increased and solidified market confidence, maintaining buying power and forming a clear trend.

A large inflow exceeding $600 million represents the entry of institutional or whale-level funds, which can usually drive a stronger and more sustained upward market.

Netflow Conditions and BTC Price Action

From the chart below, it can be observed that when Condition 3 was triggered on 2023/03/10, the price increased by more than 30%. On 2023/03/01, Conditions 1 and 2 were triggered but did not result in a sustained upward movement, while the remaining instances showed price increases.

We can see from the chart below that when Condition 1 and Condition 2 are met, the price of BTC always increases (17% to 31%).

We can see from the chart below that when Condition 1 and Condition 2 are met, the price of BTC always increases (7% to 55%).

Summary

This article conducted historical backtesting using CryptoQuant's USDC (ERC20) Netflow indicator, pointing out that significant stablecoin inflows into exchanges are often accompanied by notable increases in the Bitcoin market. From the sample period of 2023/01/01 to 2025/05/05, we observed a total of:

14 instances where both Condition 1 and Condition 2 were met simultaneously, with an average price increase of 22.78%, and only one instance where an upward movement did not follow.

Condition 3 (large single-day inflow) occurred only once, with BTC subsequently rising by over 34.98%.

This indicates that the three Netflow conditions are highly indicative, especially when the inflow amount exceeds $100 million for three consecutive days, which often foreshadows a trend of institutional or large-scale investor entry and reflects a shift in market liquidity.

In practice, this model can serve as a reference signal for investors before establishing long positions, and is particularly suitable for strategic asset allocation and the trigger condition settings of quantitative trading strategies. Future research can further observe the applicability of this model to different stablecoins (such as USDT, DAI) or other on-chain assets to enhance its value as a cross-chain fund flow observation tool.

In conclusion, the behavior of USDC net inflows not only reveals potential shifts in market sentiment but can also serve as an early signal for predicting bullish trends, making it worthy of continuous tracking as a medium-to-high weight factor in investor and trading strategy models.

Disclaimer

This report is for informational sharing purposes only and does not constitute any form of investment advice or basis for decision-making. The data, analysis, and opinions cited in this article are based on the author's research and publicly available sources and may be subject to uncertainty or change at any time. Readers should make investment judgments prudently based on their own circumstances and risk tolerance. For further guidance, it is recommended to seek professional advice.

DA Labs —— Bridge the Fintech Gaps